Securities Donation

Getting started with stock donations

Our process takes about five minutes or less for donors to complete. Learn more in our full guide of how to use the Cocatalyst platform as a donor.

Tax Benefits

Tax Benefits of securities donations to Charitable Non-profits

When you give stocks, cryptocurrency, ETFs, or mutual funds to a nonprofit, you are giving more in terms of value, without having to pay more out of pocket. Donating appreciated stock is up to 37% more tax-efficient than cash. The difference comes from the capital gains taxes that would have had to be paid when the stock is sold. When you donate stocks directly to a non-profit, neither you nor the charity will have to pay capital gains tax on such investments. Also, you will still receive the tax receipt for the fair market value at the time of donation.

For instance, let’s assume your state and federal tax rate on capital gains is 35%, and you want to donate $10,000. If you acquired Apple stock at $100, and it’s now trading at $250, you could donate to the charity 40 shares to reach your $10,000 goal. However, if you sold the stock either now or in the future, those Apple shares would only be worth $7,780. You would have to sell 9 additional shares to make up the difference. Whether you donate with stock or cash, your deduction will still be $10,000 on your tax returns. However, it’s clear that donating with stock increases your total tax efficiency and allows you to make more impact.

Here is an example of this works in practice:

SELL STOCK AND DONATE CASH

When you sell appreciated stock, up to 37.1% is taxed.

By selling shares for $10,000 originally bought for $3,000, between state and federal taxes, up to 37.1%, or $2,597 is taken. That leaves only a $7,403 donation and deduction.

DONATE STOCK DIRECTLY

When you donate appreciated stock, non-profits keep 100%, and you receive the full market value deduction.

By donating shares worth $10,000 that was bought for $3,000 of stock, you get the full $10,000 deduction and the charity keeps 100% of the stock value.

Tax Strategies with donations

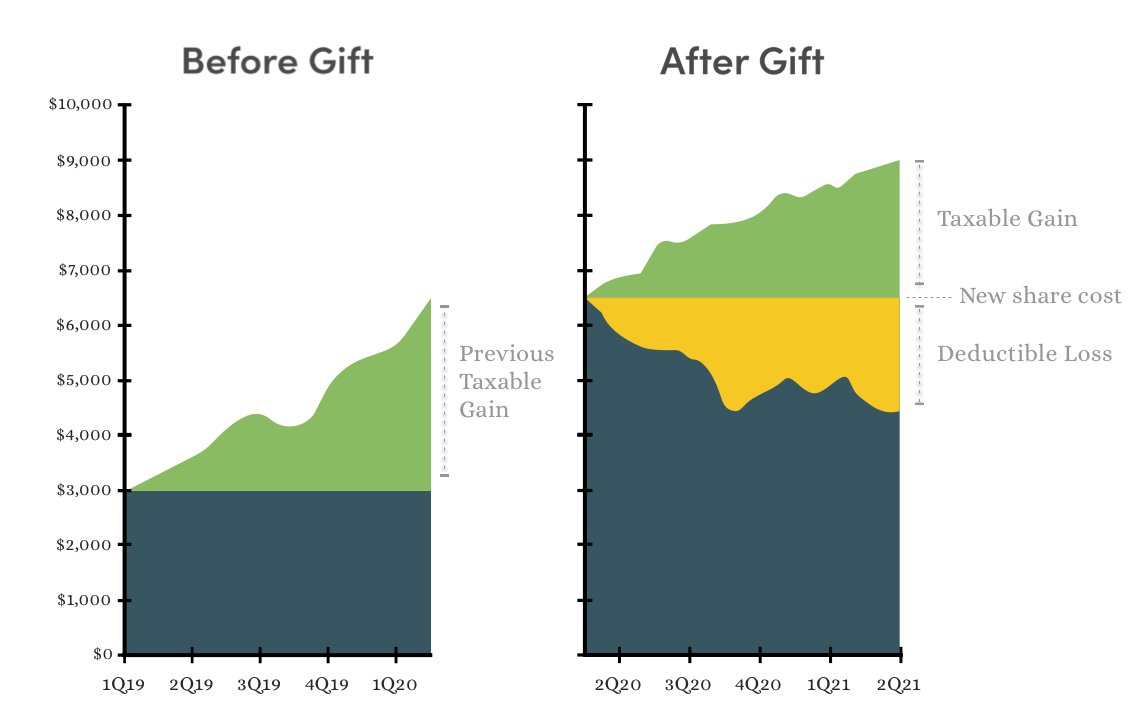

If you want to remain invested in a stock, donate existing lots and repurchase with cash. This removes future taxes.

Sarah bought Apple on Jan of 2017 for $3,000. In Feb of 2018, she donates the shares (market value of $6,500) and receives the deduction for $6,500 on her 2018 tax returns. On the same day, Sarah repurchases the same number of shares using $6,500 cash.

When Sarah sells the shares after the Feb 2018 repurchase:

At a gain, she’ll only be taxed at the price excess of $6,500.

At a loss, she’ll get all the deduction benefits from the cost basis of $6,500.