How To Deduct Appreciated Stock Donations From Your Taxes

overview

When donating stock, make sure to pick the ones with the highest appreciated gains.

Deducting stocks is easy to do by filling out the right form or entering it in your tax preparation tool.

Use Cocatalyst to make a stock donation in 5 minutes or less.

We all want to save more come tax season. Charitable contributions are an excellent and well-known way to deduct more from our taxes, while improving our communities. But of course, when tax season rolls around, somehow we always find ourselves wishing we had done more. It’s important to get into good financial health habits (such as tracking deductions) year-round, to save ourselves the headache and some cash in April.

But there’s also a way to save even more on our taxes through our charitable giving. It’s not just a matter of giving more; it’s also a matter of how we choose to donate our funds to organizations. The most tax-efficient way to make charitable contributions is by donating stock. In this article, we’ll go over everything you need to know about deducting stock donations, whether you’re going through a service or donating yourself.

Tax Benefits of Donating Stock

Donating stock saves you big for one simple reason: capital gains tax.

Let’s say you bought 20 shares of AAPL stock in September 2018 ago for $3,010. In December 2019, those same shares are worth $5,870. That represents a gain for you of $2,860. That’s fantastic! You might be thinking about selling off the shares, and using that for your charitable contribution this year, so you can deduct a large amount from your taxes.

You’re off to a great start – but wait before you sell that stock! If you sell the shares with the gain, you will have to pay capital gains tax up to 37%. In this case, you’d be paying $1,060 in taxes. That leaves you with $4,810 of your proceeds in cash to donate to the organization of your choice.

Instead, if you donate the 20 shares, neither you nor the organization has to pay capital gains tax. They receive the full $5,870 and that’s what you write off on your 2019 taxes. That extra $1,060 makes a huge difference to any local organization: it might mean expanded programming at the community center, extra staff on a campaign, or a new library for your religious institution. Plus, you get to bypass capital gains tax. It’s a win-win!

Donating stock doesn’t have to be complicated. There are services that streamline the entire process, minimizing the work you have to do, and making sure the organization gets their amount easily. To donate stock through Cocatalyst, all you have to do is fill out the form, complete the signature, and submit – we handle the rest, including a tax receipt. Charitable organizations can even set up a profile on Cocatalyst so that all their stock donations are processed through the same service, reducing their headache and allowing them to connect with donors about their mission instead of forms.

But whether you’re handling your stock donation yourself or using a service, you want to make sure you know what information to track so you can deduct the correct amount from next year’s taxes.

Choosing Stock to Donate

Don’t wait to start figuring this stuff out until you’re cracking open your 1040 tax return. It’s best to make your donation with a full understanding of what you need in order to get the biggest deduction possible.

Choose the stock with the highest gains to maximize your tax savings. Make sure you are donating appreciated stock that you have held for at least a year or more. If you would have short-term capital gain from the sale of the stock, then you have to subtract this appreciation from the fair market value in order to arrive at your deduction. This is why it’s best to donate stock that you have held for a year or more. After a year, this is no longer considered a short-term capital gain, and you can deduct the full fair market value without subtracting your basis.

If you’re considering donating a losing stock, it’s better to sell the stock and take the capital loss. Then, you can donate the cash value directly to your desired organization.

Be prepared to take an itemized deduction. If you take a standard deduction, there will be no way for the full value of your donation to be reflected in your taxes. The CARES Act allows you to deduct up to $300 in donations along with a standard deduction, but anything beyond that will need to be itemized.

If you have been granted stock options by your employer, we recommend you exercise the options and hold the stock for at least one year before donating. If you donate the shares before the one year limit is up, your deduction will be limited to the exercise price. You can read about donation strategies for stock options.

Now let’s get into the nitty gritty of deducting your stock donation from your taxes.

Tax Receipts

There are a few things to keep in mind to make sure that you get the biggest deduction possible form your tax donation.

Non-cash charitable donations of over $5,000 must have written acknowledgment. This includes donations of appreciated stock. You will deduct the fair market value, which is calculated as the midpoint between its highest and lowest prices on the day it is received by the charity. Make sure that your tax receipt reflects the correct day and the correct value of your donation.

You determine how much to deduct for a contribution of capital gain property by its fair market value on the day of the sale. This means that if you donate $10,000 worth of stock that you have held for at least a year, you can deduct $10,000, no matter what you paid for it.

When you make your donation, you’ll need to receive a tax receipt from the organization or the service that is processing your donation. All noncash contributions must have a receipt stating what was donated; in other words, it should say that you donated a certain number of shares of stock from a certain corporation, and it should say the date.

Tracking Your Deductions

There are many great ways to keep track of your deductions through the year. TurboTax allows you to track deductions year-round in their ItsDeductible program, and then import your donations directly into TurboTax.

Track manually in a Google Spreadsheet or Excel file. You can make a row for each donation, and track the relevant information from each donation (listed below). The important thing is to have a system that makes sense to you and provides all the information that you will need come tax season. If a small filing cabinet has worked for you for the past 20 years – great! Just make sure all the information you need is in there and is clearly labeled.

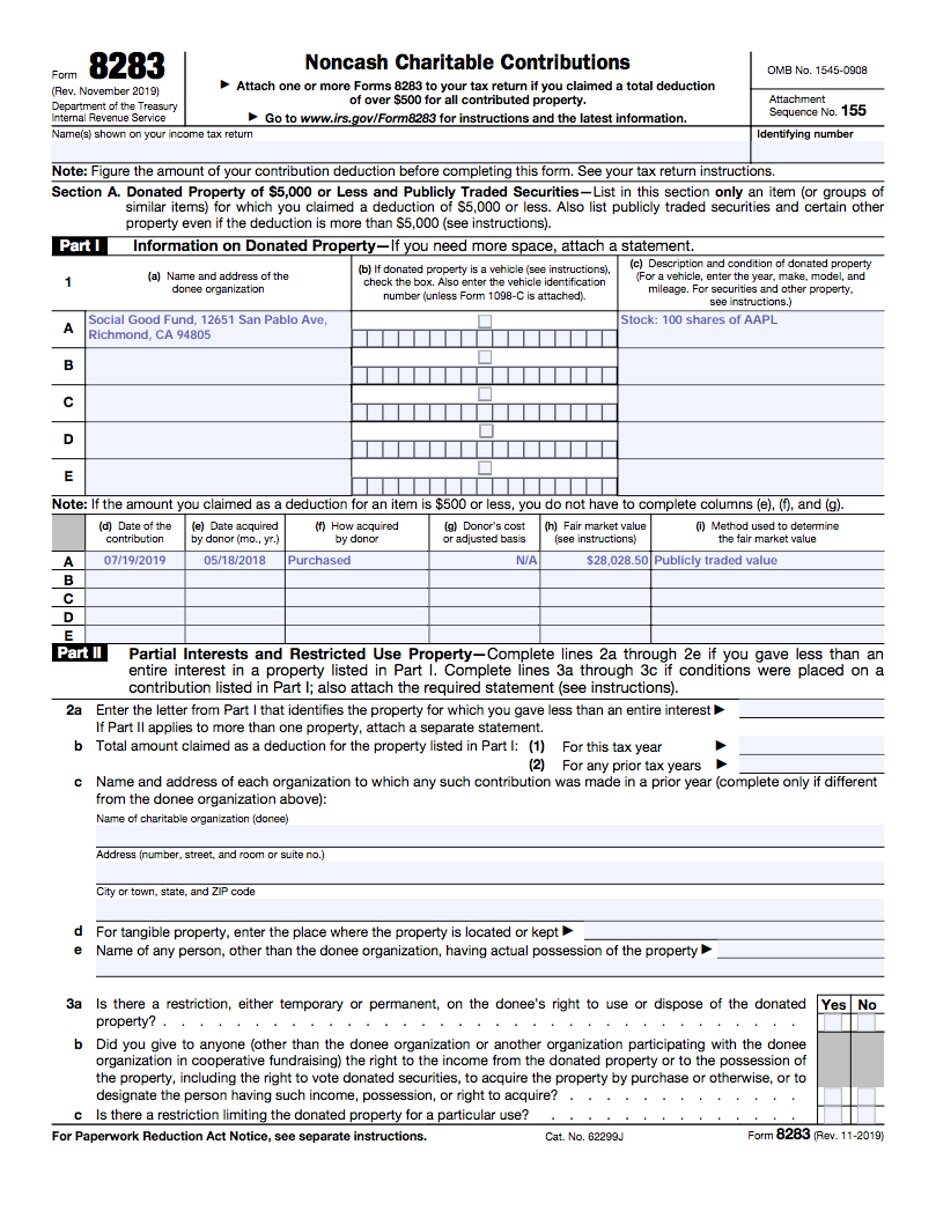

Filling Out Your Tax Forms: Form 8283

Form 8283 is the Noncash Charitable Contributions form for the 1040 tax return. If you’re using a tax service, they’ll ask you the appropriate information to populate this form. Either way, you’ll need to have the information at the ready.

When you’re tracking deductions for this form, make sure you have:

The name and the address of the organization you donated to.

Description of the donated property (the number of shares and the name of the company).

Date of contribution.

The fair market value of the property (market value).

The method used to determine the fair market value.

Date acquired by the owner (month and year).

Entering Stock Donations Deductions Manually

If you are not using a tax service, you will need to fill out Form 8283 directly. The donor from our earlier example would fill the form out like so:

Form 8283 used for Stock Donations

You’ll need to fill in your name, identifying number, and the information (as listed above) for your stock donations overall in Part I. You will only need to worry about Part II if you donated partial interests. Notice that as long as you have held the stock for over a year, you do not need to list the cost basis on this form.

If you donated only publicly traded securities for the year, you will not need to worry about Section B, including the signature.

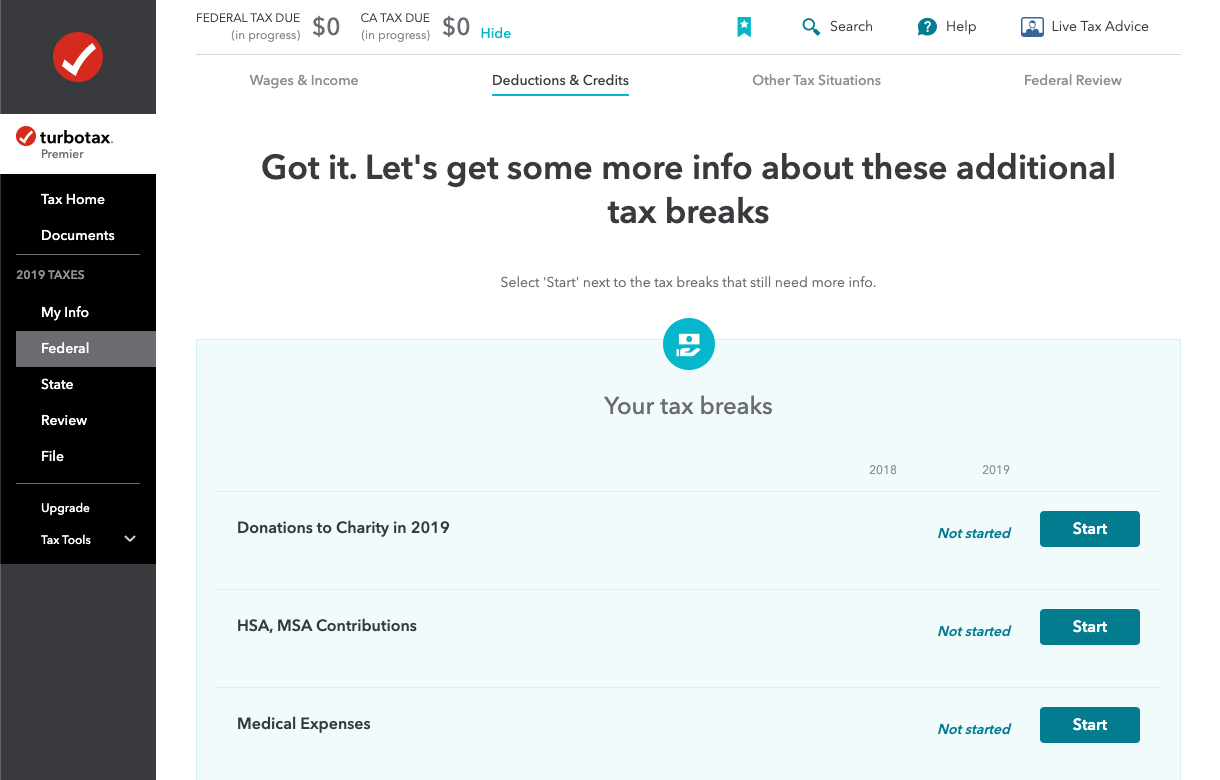

Stock Donation Deductions in TurboTax

Most people use tax software to streamline their tax form process, such as TurboTax and Credit Karma. If you’re using TurboTax, start their system for “Donations to Charity in 2019.”

Step 1 of an Appreciated Stock Donation in TurboTax

This will take you to a screen where you can choose what type of donation you made. Click the “Add” button next to “Stock.” This will prompt you to put in the name of the charity; in our example, the Social Good Fund.

Step 2 of an Appreciated Stock Donation in TurboTax

Next, TurboTax will ask you for more details about your donation, in order to auto-populate Form 8283. You’ll need to enter the date of donation, the stock ticker, the fair market value on the day of donation, the day you acquired the stock, and your cost basis.

Step 3 of an Appreciated Stock Donation in TurboTax

Finally, TurboTax will ask you a series of questions to make sure that you are eligible for the full deduction. You’ll need to disclose if you retained partial ownership of the stock, gave the stock on a conditional basis, gave rights to your donation to others, or inherited the donation.

Step 4 of an Appreciated Stock Donation in TurboTax

It’s as simple as that!

Stock Donation Deductions in CreditKarma

If you use CreditKarma, their tax software will also support Form 8283, and they offer an extensive list of what you can and can’t deduct.

CreditKarma will provide you with an overview screen. You might not see charitable contributions at first. Search for them in the search bar, or click “Browse More” under the “Looking for something else?” section.

Step 1 of a Stock Donation in CreditKarma

When you click to “Browse More,” you’ll be taken to a screen full of possible deductions. Under “Personal Expenses,” you’ll find “Donated to charity.” Select this option.

Step 2 of a Stock Donation in CreditKarma

Next, CreditKarma will give you the relevant forms to deduct charitable contributions. Press “Start” for “Cash and non-cash gifts to charity.”

Step 3 of a Stock Donation in CreditKarma

CreditKarma will ask you whether your donation totaled more than $500. If it did, click yes.

Step 4 of a Stock Donation in CreditKarma

Next, you’ll be given an option to add a new noncash gift. Select this option to claim your stock donation.

Step 5 of a Stock Donation in CreditKarma

Finally, CreditKarma will prompt you to enter the relevant information about your gift to populate Form 8283. Enter the name of the organization, the date of the contribution, and the fair market value of the item.

Step 6 of a Stock Donation in CreditKarma

Then, continue through their prompts to give them all the necessary information.

In Conclusion…

Keep this list around when you’re planning your stock donation. It’s a handy reminder of what you need from your organization and the stock donation service you’re using, or your broker. Then, track the information digitally, or put it in a safe place where you’ll be able to work with it come tax season.

If you’re making a big end of year contribution, make sure you start the process early. There’s nothing worse than a donation getting processed on January 2 instead of December 30! Using a streamlining service like Cocatalyst to streamline your appreciated stock donations can help you avoid issues like this – but so can making your donation on December 1.

Stock donations don’t have to be complicated, and deducting them from your taxes doesn’t have to be, either. You’re all set to make this simple change to save the most on your taxes this year.